Series 3 episodes

Episode 3

Introduction

Series 2 episodes

Introduction

Series 1 episodes

Introduction

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets, CFDs, OTC options or any of our other products work and whether you can afford to take the high risk of losing your money.

The Artful Trader series 3

Confidence uncovered

Being a trader takes confidence. In the markets, in your strategy, in your self – in having the confidence to execute that trade. In this unique series, we talk to the experts in their own fields to uncover what gives them the confidence to succeed. We also look at the dangers of overconfidence, and ways in which top performers keep their egos in check.

Join us as we uncover confidence and unlock the secrets behind resilience, preparation, determination and growth - and how it can make you a better trader.

Meet the hosts:

Michael McCarthy & Michael Hewson

Michael McCarthy

Chief Market Strategist, CMC Markets (Asia Pacific)

With more than 30 years' experience in the financial markets, Michael provides local and global market analysis for the Asia-Pacific region, formulates trading strategies and plays a key role in educating clients. Michael specialises in derivative trading, and views the global financial markets as a vast interconnected matrix. Michael demonstrates a deep understanding of the ramifications of developments in a market and their potential impact on other tradeable instruments.

Michael Hewson

Chief Market Analyst, CMC Markets (UK)

Michael holds over 25 years' experience trading the financial markets, specialising in technical analysis. Michael’s primary focus is on providing technical and fundamental analysis on the daily movements in financial markets, as well as research articles focused on topical financial and economic issues. Michael also participates in regular trading webinars for clients, and delivers seminars across the UK, catering for varying levels of experience.

Meet the series 3 speakers

Sara Laamanen

Sara Laamanen coaches trading experts and executive CEOs using rapid transformational therapy (RTT). Sara unlocks the subconscious minds of her clients to reclaim lost confidence, by unpicking the root causes of low self-esteem and helping traders to manage the relationship between emotions and its impact on behaviour.

Dave Floyd

Dave is founder of acclaimed FX firm, Aspen Trading Group, providing expert FX research and analytics to both institutional and retail clients worldwide. Dave has over two decades of expertise in technical analysis and global fundamentals.

John Netto

John is an acclaimed author and the founder of the ground-breaking Netto Numbers. He is an expert in developing, executing, and managing proprietary algorithmic and discretionary trading strategies across a range of time horizons, asset classes, and market regimes.

Pat Rafter

Pat Rafter is one of Australia’s most successful tennis players and the nation’s only male to win back-to-back US Open titles. Rafter won fans around the world for his sense of humour and commitment to fair play. Since his retirement, Pat has swapped volleys for property and built an impressive portfolio around Australia.

Harry Crane

Scholar who specialises in statistics and probability. He is currently a professor of statistics at Rutgers University.

Mouhammad Chouiker

Deputy CEO and Chief Investment Officer at Kleinwort Hambros. He heads up the investment management, credit, banking and trust divisions and is responsible for the firm's growth strategy including technology transformation.

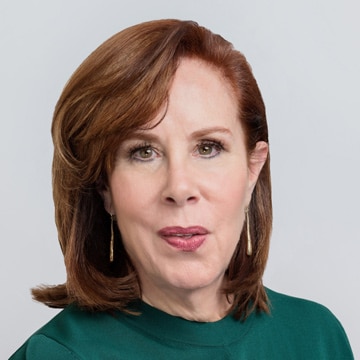

Denise Shull

Performance coach who uses neuroeconomics and modern psychoanalysis in her work with hedge funds and professional athletes. She was the inspiration behind the world-famous TV Series, 'Billions'.

Tim Fung

Co-founder & CEO of start-up Airtaster, a services marketplace allowing people to outsource chores and errands to people in their local neighbourhood community.

Oleg Vornik

Founder and CEO of DroneShield (ASX:DRO) a worldwide leader in drone security technology. DroneShields' leadership brings world-class expertise in engineering and physics, combined with deep experience in defence, intelligence, and aerospace.

Drew Bilbe

Co-Founder and CEO of Nexba. Nexba is one of Australia's fastest growing drinks companies selling their low-calorie products at more than 3,000 outlets, including Coles supermarkets and Virgin Airlines.